This article is essential for non-resident entrepreneurs looking to expand their business operations into the European market.

It's particularly valuable for business owners from outside the EEA who want to take advantage of Ireland's favorable corporate tax system and strategic location as an EU gateway.

Key Takeaways

- Ireland allows foreigners and non-residents to establish companies without living there, but require either an EEA-resident director or a non-resident director bond

- The private limited company (LTD) structure offers the best combination of liability protection and operational flexibility for most international entrepreneurs

- Ireland's 12.5% corporate tax rate on trading income is among Europe's most competitive, with additional tax benefits for innovative businesses

- Virtual office solutions provide a cost-effective way to meet the registered office requirement while managing your business remotely

- Professional company secretarial services are valuable for non-resident owners to ensure ongoing compliance with Irish company law requirements

Are you looking to start a business in Ireland without living there?

Ireland allows people to start a company there from anywhere in the world - there is no requirement to be present in Ireland to set up a company but there are certain hurdles to jump over - but generally speaking it's a very straight-forward process.

This guide covers everything you need to know about setting up your business in Ireland as a foreigner.

What are the Requirements to Register a Company in Ireland as a Foreigner?

Setting up a company in Ireland as a foreigner is straightforward, but you must meet certain requirements. To establish a business in Ireland as a foreign entrepreneur, you need:

- At least one director who is a resident of the European Economic Area (EEA)

- A registered office address located in Ireland

- A company secretary (who can be one of the directors if there are multiple directors)

If you don't have an EEA-resident director, you can apply for a non-resident director bond. This insurance bond covers potential tax defaults and will cost around €1,600 for a two-year period.

An alternative option for those with an innovative business idea who are actually interested in moving to Ireland to start their business, the Start-up Entrepreneur Programme provides a pathway for that. This programme requires an innovative business idea and funding of at least €50,000.

Essential Documents for Company Formation in Ireland

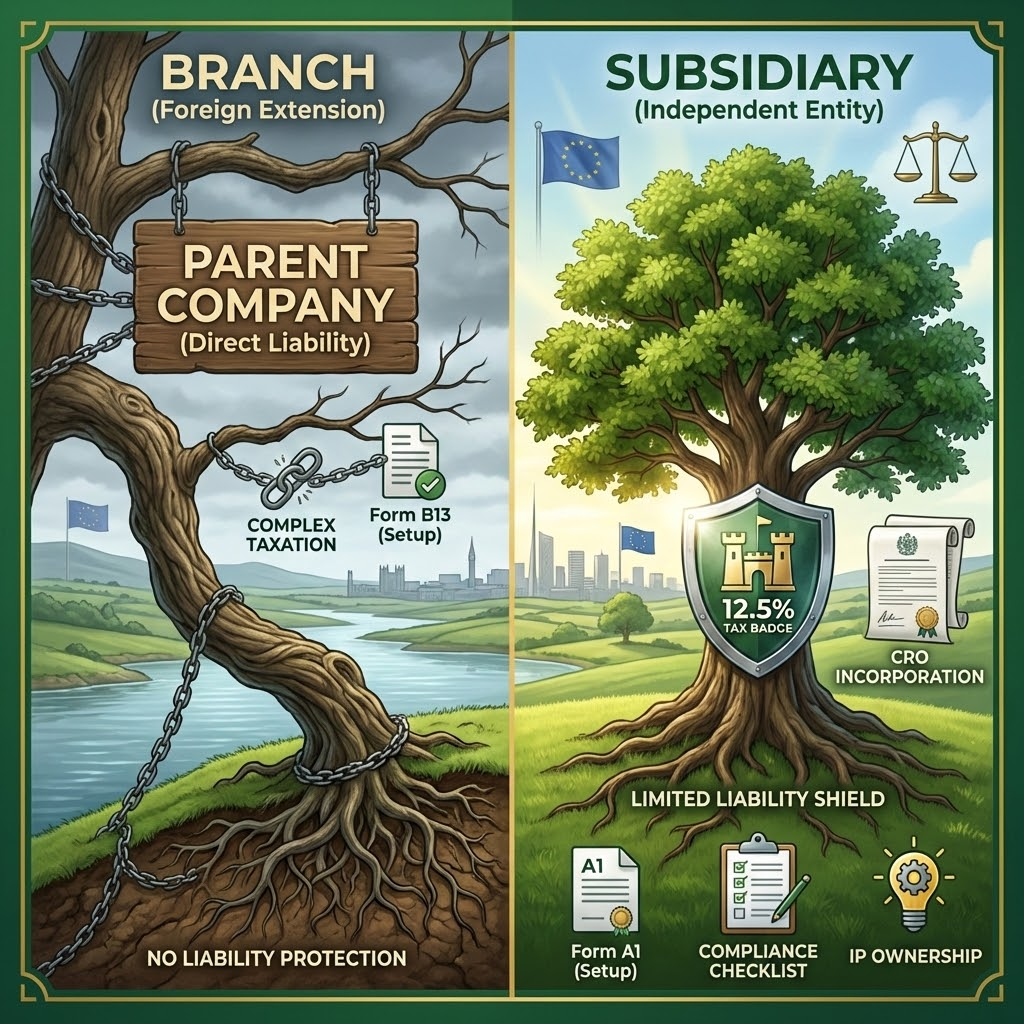

When you set up a business in Ireland, you must prepare several key documents:

- Constitution (formerly known as Memorandum and Articles of Association) - This defines your company's rules and structure

- Form A1 - The company incorporation form submitted to the Companies Registration Office (CRO)

- Legal registers and share certificates (this is the Company Secretary's job)

- Business Name Registration (if trading under a name different from your company name)

Each document must comply with Irish company law, and mistakes can delay your registration process.

Do You Need to Live in Ireland to Open a Business?

No, you don't need to live in Ireland to establish a business there. Ireland offers a flexible framework allowing entrepreneurs to set up and manage companies remotely.

However, your company must:

- Maintain a registered office in Ireland

- Have either an EEA-resident director or a non-resident director bond at all times

- Stay compliant with all reporting and tax obligations

Many international business owners successfully manage their Irish operations from abroad, using local service providers like Open Forest to ensure compliance with Irish regulations.

Company Secretary Requirements for Non-Residents

Every limited company in Ireland must appoint a company secretary. This role can be filled by:

- One of your company directors (if you have multiple directors)

- A separate company secretary service provider such as Open Forest (we do this for €99 per year)

- An independent professional with appropriate skills and knowledge

For non-residents, hiring a professional company secretary service like Open Forest is often the most practical solution. We can handle essential compliance tasks including:

The company secretary doesn't need to be resident in Ireland, but having someone familiar with Irish company law is highly advantageous.

Virtual Office Solutions for Foreign Business Owners

When setting up a new company in Ireland without relocating, virtual office solutions provide an ideal answer to address requirements.

These services typically include:

- A registered office address in Ireland

- Mail handling and forwarding

The term "virtual office" can be a bit misleading because under Irish law, there has to be an actual physical location - which is what Open Forest provides you and so to you, it is your "virtual office".

Virtual office packages cost €199 yearly (which is up to 5x cheaper than others on the market). This arrangement allows you to establish a business in Ireland while maintaining your operations elsewhere.

What Business Structure Should You Choose When Starting a Company in Ireland?

Ireland offers several business types for entrepreneurs looking to start a business:

Private Company Limited by Shares: The Most Popular Irish Business Structure

The private limited company (LTD) is the most common business structure in Ireland. Benefits include:

- Limited liability, separating personal assets from business debts

- Simple corporate governance structure

- No minimum capital requirements

- Flexibility in management structure

- Only one director required (plus company secretary)

Other possible structures include:

- Designated Activity Company (DAC) - Similar to an LTD but with a defined area of activity

- Public Limited Company (PLC) - For larger businesses that wish to offer shares to the public

- Unlimited Company - Offers no liability protection but greater privacy

- Partnership - Suitable for professionals who want to work in Ireland as partners

For 99% of foreign entrepreneurs, the private limited company structure provides everything that is needed (unless you are an investment fund or otherwise).

How to Register Your Company with the Companies Registration Office?

Registering an Irish company involves submitting your application to the Companies Registration Office (CRO). This can be done online and will take around 10 working days if you do it yourself (assuming no mistakes in your application which will stop the clock running).

Open Forest can half that time for you and ensure that no mistakes are made.

Step-by-Step Company Registration Process for Non-Residents

To incorporate a company in Ireland as a foreign entrepreneur, follow these steps:

- Choose your business structure (most commonly a private limited company)

- Select and check availability of your company name

- Appoint directors and company secretary

- Arrange your registered office address in Ireland

- Prepare your company constitution

- Complete Form A1 and submit all documents to the CRO

- Pay the registration fee (€50 for online filing)

- Receive your Certificate of Incorporation

Once registered, your company must register for taxes with the Revenue Commissioners within 30 days.

What are the Tax Implications of Setting Up an Irish Business as a Non-Resident?

Setting up a business in Ireland as a non-resident has significant tax implications that require careful planning.

Understanding Ireland's Corporation Tax System for Non-Residents

When you establish a business in Ireland, your company becomes subject to Irish tax on its worldwide income. Key points include:

- 12.5% corporation tax rate on trading income (one of the lowest in Europe)

- 25% on non-trading income (such as rental or investment income)

- Extensive double tax treaty network (73+ countries) helping prevent double taxation

- Requirement to register for taxes immediately after incorporation

Non-resident directors may also have personal tax obligations in Ireland depending on their involvement in the company and the time spent in Ireland.

Corporate Tax Rates and Benefits for New Business Owners

Ireland offers an attractive tax environment for businesses, particularly those with innovative business ideas:

To manage your tax affairs effectively, most non-resident owners engage Irish tax advisors who understand both Irish requirements and international tax implications.

How to Manage Your Irish Business from Abroad?

Successfully running an Irish company as a non-resident requires careful planning and local support.

Legal Requirements for Running an Irish Company as a Non-Resident

When managing your Irish limited company from overseas, you must:

- Maintain proper books and records

- File annual returns with the CRO

- Submit tax returns to Revenue

- Hold board meetings (which can be conducted virtually)

- Keep statutory registers updated

- Open a business bank account in Ireland

There are a number of banking options out there for non-residents.

Many entrepreneurs expand into Ireland by using service providers who handle day-to-day compliance, allowing you to focus on growing your business.

If you are ready to go, follow the link below.

Stuart Connolly is a corporate barrister in Ireland and the UK since 2012.

He spent over a decade at Ireland's top law firms including Arthur Cox & William Fry.

.webp)

.webp)

.webp)