This comprehensive guide is designed for German entrepreneurs, business professionals, and investors considering establishing a company presence in Ireland.

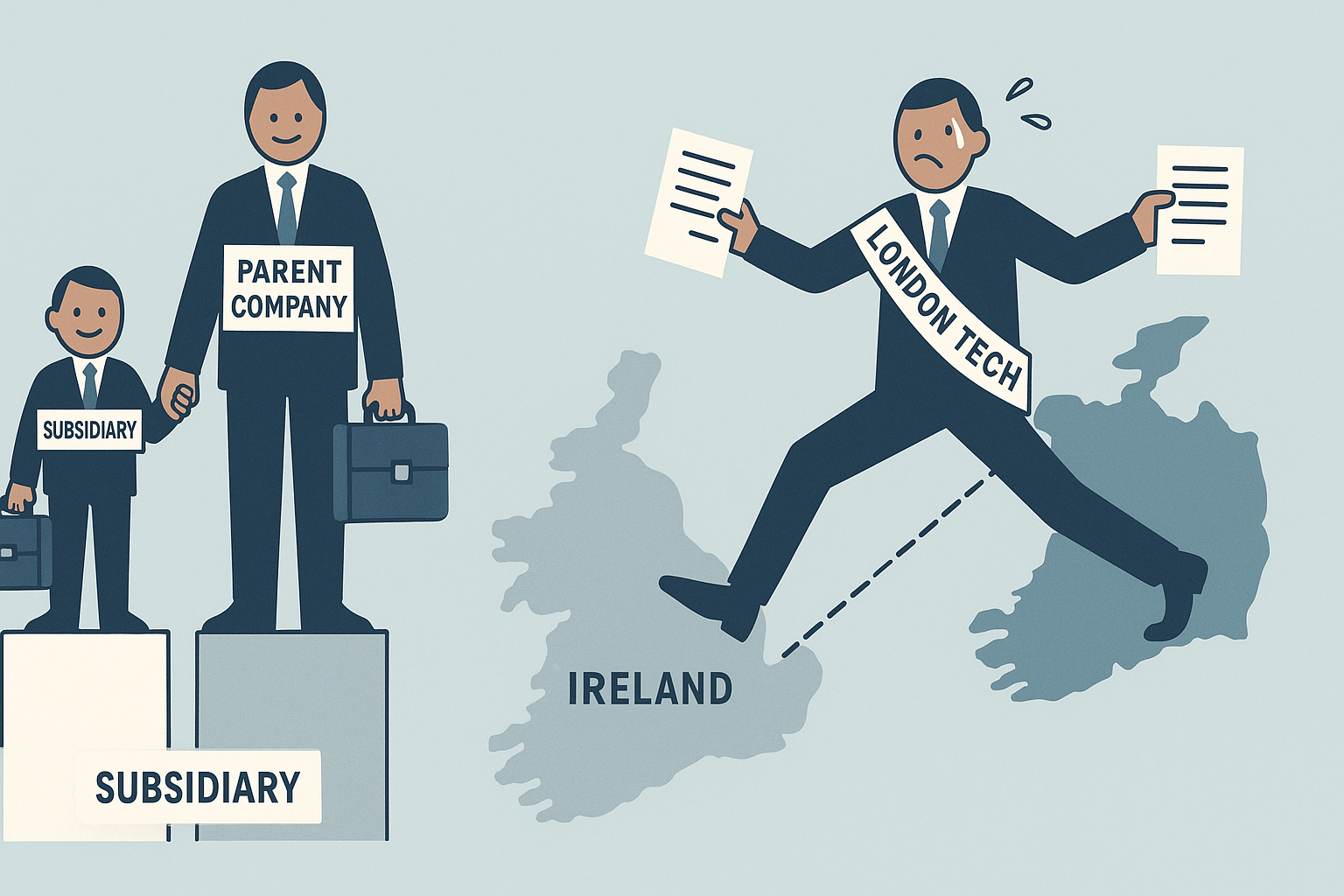

Whether you're seeking to expand your German business into English-speaking markets, benefit from Ireland's competitive tax environment, set up a holding company for your German trading company, or establish a strategic EU base of operations, this article provides everything you need to know about Irish company formation for German residents.

Key Takeaways

- German residents can easily establish Irish companies thanks to EEA residency requirements being automatically satisfied

- Ireland offers an attractive 12.5% corporation tax rate alongside English-speaking business environment and strong legal framework

- Essential requirements include appointing a company secretary, securing a physical registered office in Ireland, and obtaining VIN numbers for directors without Irish PPS numbers

- The incorporation process typically takes 5-7 business days and can be completed entirely remotely

- Professional formation services streamline compliance requirements and ongoing corporate governance obligations

For complete pricing information for German residents establishing Irish companies, visit our Pricing Page.

Why German Entrepreneurs Choose Ireland for Business Formation

Hallo! Wie geht's denn so?

Ireland has emerged as an increasingly popular destination for German businesses seeking strategic expansion opportunities. The combination of Ireland's EU membership, competitive tax landscape, and English-speaking environment creates unique advantages for German entrepreneurs.

Following Germany's continued EU membership alongside Ireland, establishing an Irish company provides German residents with seamless access to both the Irish domestic market and broader European opportunities. Ireland's reputation for business innovation, coupled with its stable regulatory environment derived from English common law traditions, makes it particularly attractive for German companies seeking predictable operational frameworks.

This guide explains the complete process of establishing your Irish company from Germany, covering director requirements, compliance frameworks, and practical implementation steps for successful cross-border business formation.

Differences between Irish and German Companies

The following is a high level overview of the differences between an Irish limited company and a German GmbH:

Director and Officer Requirements for German Residents

EEA Residency Advantage for German Citizens

One significant advantage for German residents establishing Irish companies is the automatic satisfaction of EEA residency requirements.

Irish company law states that every company maintains at least one director who resides within the European Economic Area at all times. As a German resident, you automatically fulfil this requirement, eliminating the need for additional bonds or complex workarounds.

Just note that it is a residency requirement, not a nationality requirement. Even if you are a German national or citizen, you can't be living outside of the EEA while setting up an Irish company - unless you have someone else in your team that will be resident in the EEA.

Director Qualification Criteria

Directors of Irish companies must meet specific qualification standards:

- Minimum age of 18 years

- No disqualifying convictions or bankruptcy restrictions

- Ability to fulfil fiduciary duties under Irish company law

- Residence verification within the EEA (automatically satisfied for German residents)

Multiple directors can serve on Irish companies, with no maximum limitations. Additional directors may be based anywhere globally, provided at least one maintains EEA residency.

Identity Verification for German Directors

Verified Identity Number (VIN) Process

German directors establishing Irish companies typically require Verified Identity Numbers (VINs) since they won't possess Irish Personal Public Service (PPS) numbers. The VIN serves as identity verification for company registration purposes.

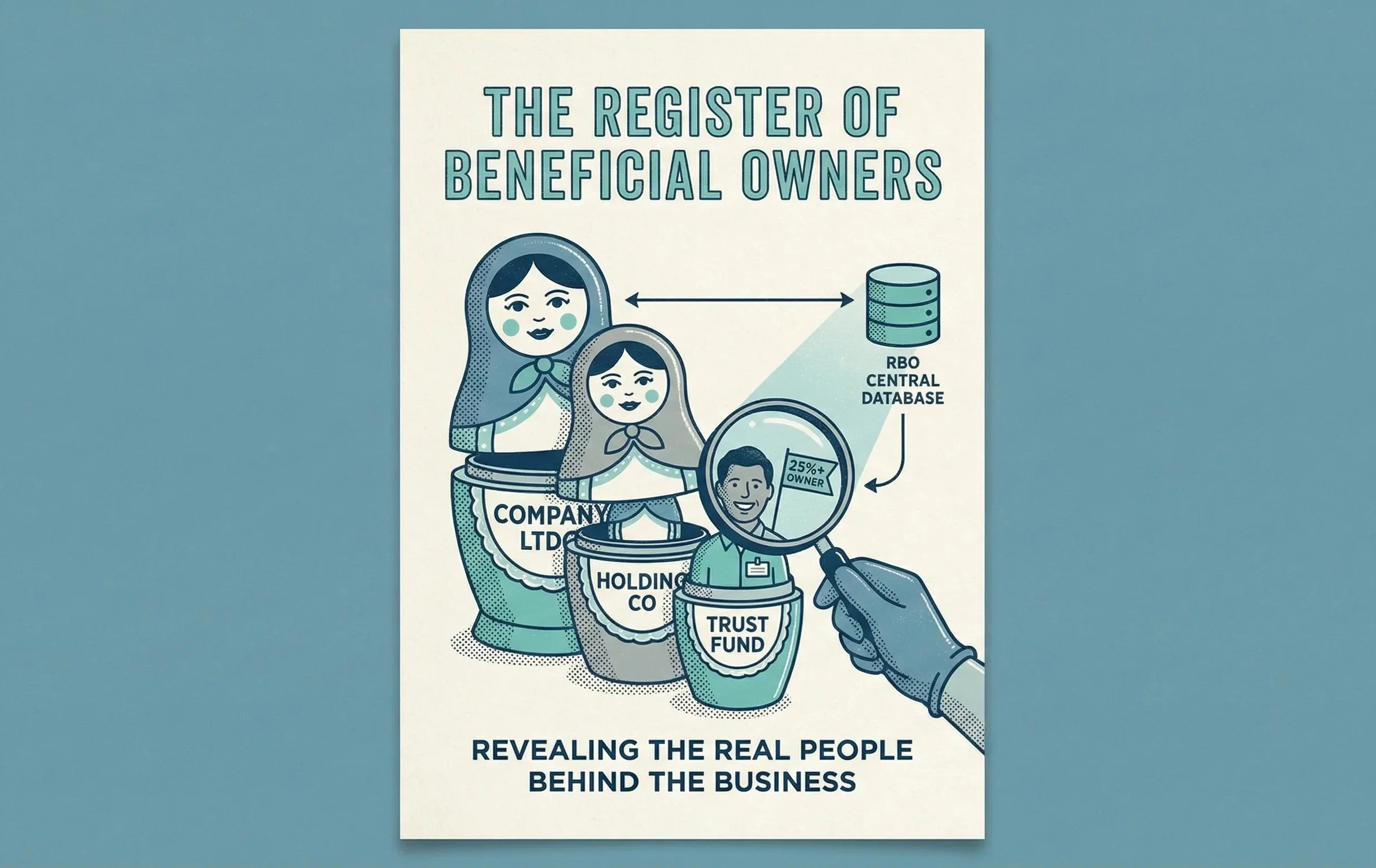

Shareholder Identity Requirements

German residents holding significant shareholdings (over 25% of company shares) must also obtain VINs for beneficial ownership register compliance. The process is the same as above and if you are both the director and the shareholder, you only need to get one VIN.

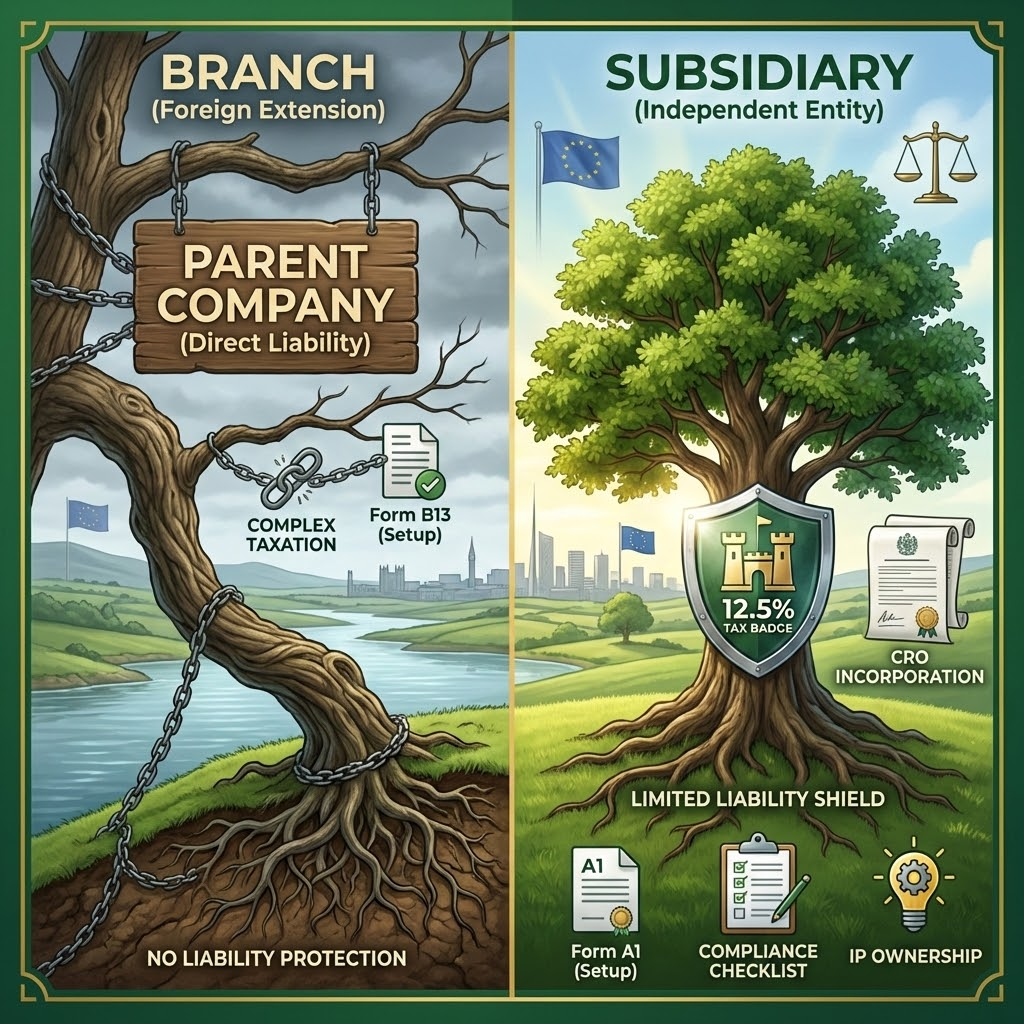

Company Secretary Appointment Requirements

Irish law requires every company to appoint a qualified company secretary responsible for ensuring statutory compliance. For companies with single directors, the secretary must be a different individual from the sole director.

Company secretaries handle important responsibilities including:

- Annual return submissions to the Companies Registration Office (CRO)

- Maintenance of statutory registers and corporate records

- Ensuring adherence to Irish company law requirements

- Managing corporate governance documentation

Many German entrepreneurs choose professional company secretary services in Ireland to ensure expert compliance management while focusing on core business activities. Open Forest can be your Company Secretary and we can do this fro €99 per year.

Registered Office and Address Requirements

Mandatory Irish Address Requirements

Every Irish company must maintain a registered office address within Ireland's borders. This serves as the official location for receiving legal correspondence, regulatory communications from the CRO, and contact from Irish Revenue authorities.

The registered office must be:

- A physical address within Ireland (postal boxes are prohibited)

- Accessible for official correspondence delivery

- Maintained as the public record address for the company

- Available for service of legal documents

We can provide you with a registered address as part of our packages for €199 per year. See our full costs below.

The Irish Company Formation Process for German Residents

Required Documentation Preparation

Establishing your Irish company requires careful preparation of several key documents:

Company Constitution: This foundational document outlines your company's operational framework, shareholder rights, director authorities, and internal procedures. German entrepreneurs can adopt standard Irish constitutional templates or customise documents for specific business requirements. You can simply choose from our packages which provide these.

Form A1 Application: The official CRO application form requiring comprehensive company details:

- Proposed company name

- Registered office address information

- Company classification and structure

- Complete director information and qualifications

- Share capital framework details

- Company secretary appointment details

All of this information is gathered from you through our friendly incorporation form.

Formation Timeline and Investment

The company establishment process for German residents typically requires:

- Incorporation Process: 5 business days

- VIN Number: Add on 2-3 days for this which has to be done before the incorporation process starts.

Post-Formation Compliance and Obligations

Immediate Post-Incorporation Requirements

Successfully registering your company marks the beginning of ongoing compliance responsibilities. Several immediate actions ensure proper legal standing:

Statutory Registers: Companies must establish and maintain:

- Register of Directors and their details

- Register of Members (shareholders)

- Register of Company Secretaries

- Register of Beneficial Ownership (for significant shareholders)

These registers require regular updates when changes occur and must be available for inspection.

Share Certificate Completion: Companies must prepare and issue share certificates to all shareholders within two months of share allocation. These certificates require proper execution by directors and company secretaries.

Of course, Open Forest will do all of this for you at no additional cost.

Annual Compliance Framework

Annual Return Filing: The first annual return must be submitted exactly six months after incorporation, with subsequent returns due annually. Late filing incurs €100 penalties plus €3 daily charges, making timely submission crucial.

This won't happen on our watch - you will have access to a personalised compliance calendar which tells you of your upcoming obligations and we will automatically remind you about them as they approach.

Financial Statement Requirements: Companies must prepare annual financial statements and file them with the CRO within prescribed timeframes. New companies usually qualify for audit exemptions under certain conditions.

Beneficial Ownership Register: Updates to beneficial ownership information must be filed when changes occur, particularly important for German shareholders holding significant stakes.

Tax Registration and VAT Considerations

Corporation Tax Registration

Irish companies must register for corporation tax within one month of commencing trading activities. While "trading" can have nuanced definitions, seeking professional guidance ensures timely compliance.

Ireland's 12.5% corporation tax rate on trading profits represents one of Europe's most competitive rates, providing significant advantages for German entrepreneurs establishing Irish operations.

VAT Registration Thresholds

VAT registration becomes mandatory when annual turnover exceeds:

- €85,000 for goods supply

- €42,500 for services provision

Voluntary VAT registration below these thresholds may benefit businesses primarily serving VAT-registered clients, allowing for input VAT recovery on business expenses.

Open Forest has partnered with a tax advisor and accountant that provides services for all Open Forest clients at the cheapest rate on the market.

Banking and Financial Setup

Irish Business Banking for German Companies

Establishing business banking typically requires:

- Certificate of Incorporation

- Company Constitutional documents

- Registered office address verification

- Director identification and verification

- Beneficial ownership documentation

Irish banking institutions offer various business account options with different fee structures and service levels. Some innovative fintech solutions may provide faster setup and more flexible terms compared to traditional banking options.

How Can Open Forest Help?

Open Forest offer the cheapest and fastest incorporation packages in Ireland including holding companies for €99 including CRO fees and access to the Open Forest platform so you can keep track of all of your legal, tax and accounting obligations - at no additional cost.

Choose from one of our incorporation packages here and we will take care of the rest.

Stuart Connolly is a corporate barrister in Ireland and the UK since 2012.

He spent over a decade at Ireland's top law firms including Arthur Cox & William Fry.

.webp)

.webp)

.webp)