This article is for entrepreneurs, dropshippers, and retail professionals looking to establish an e-commerce business in Ireland.

Whether you're launching a Shopify store, building a custom e-commerce platform, or transitioning from a physical retail presence to online sales, this guide covers the essential legal and operational considerations for Irish e-commerce companies.

Key Takeaways:

- VAT registration is mandatory at €85,000 annual turnover for goods (vs €42,500 for services), making it particularly relevant for product-based e-commerce businesses

- International shipping and customs require careful consideration of import/export regulations, especially post-Brexit for UK trade

- Consumer protection laws are stricter for online businesses, with specific requirements for returns policies, terms of service, and distance selling regulations

- Payment processing compliance including PCI DSS requirements and strong customer authentication under EU regulations

Ireland's e-commerce sector has exploded, with online retail growing by over 25% annually since 2020. The country's strategic position as a gateway to EU markets, combined with excellent digital infrastructure and English-speaking environment, makes it an ideal base for e-commerce operations targeting both Irish and international customers.

Why Ireland is Perfect for E-commerce Companies

Ireland offers a compelling combination of advantages that make it particularly attractive for e-commerce businesses. The most obvious benefit is seamless access to 450 million EU consumers without customs barriers or currency complications within the eurozone. This single market access is invaluable for businesses looking to scale beyond their home market.

The country boasts some of Europe's most advanced digital infrastructure, with major tech companies choosing it as their European headquarters. This creates a supportive ecosystem where e-commerce businesses can access world-class cloud services, payment processors, and logistics providers. Dublin and Cork ports provide excellent connections to the UK and mainland Europe, while Dublin Airport offers extensive cargo capabilities for businesses handling their own fulfillment. Ireland now has an Amazon distribution centre which is ideal for running dropshipping businesses.

From a tax perspective, Ireland's 12.5% corporate tax rate applies to trading income, and e-commerce businesses can claim substantial deductions for technology, marketing, and operational expenses. The English-speaking business environment also simplifies customer service, marketing, and business operations when targeting English-speaking markets globally.

Opening a company in Ireland also allows you to register a VAT number for selling to European customers.

EEA vs Non-EEA Residents

What you need to set up your e-commerce business depends on where you live:

Residency rules can be complex. Some rules depend on where your company is based, others depend on where team members live. You can find full details in the article above.

What You Need Before Registration

Before you register your online store, you need to arrange for a couple of key requirements listed below. Don't worry about these requirements - Open Forest can help with all of them.

Directors

Every Irish company needs at least one director who lives in the European Economic Area (EEA). For e-commerce businesses, this often affects how you structure your founding team. This is especially true if you're from outside Europe but want to set up in Ireland to access EU markets.

If you don't have an EEA-resident director, you can still set up an Irish company, but you will need to buy a Section 137 Bond for about €1,600. You need to renew this every two years.

VIF (Verified Identity Number)

Unless you have an Irish PPS number, all directors and shareholders with more than 25% ownership need a Verified Identity Number (VIF). This costs €150 per person and adds about 5-7 days to the setup process.

Company Secretary

Irish law says every company must have a company secretary. They make sure you follow all legal requirements. If you're the only director of your e-commerce business, the company secretary must be someone else - you can't do both jobs.

Registered Office

Every Irish company needs a registered office address in Ireland. This is where you get legal notices and letters from the Companies Registration Office (CRO) and Revenue. It must be a real address, not a P.O. Box. You can use our Registered Office service for this.

Costs and Timelines

Understanding all the costs helps you plan your e-commerce business budget properly. This avoids unexpected expenses that could hurt your cash flow during launch and when buying stock.

Pricing Calculator

Basic setup costs start from €99 with Open Forest. This includes all CRO fees and access to our compliance platform. Extra costs depend on your situation:

- VIF applications: €150 per person who needs identity verification

- Section 137 Bond: €1,600 for two years (if no EEA-resident director available)

- Professional registered office: €199 per year for Open Forest's virtual office services

- Company secretary service: €99 per year for professional management

You can use our pricing calculator to work out your exact costs.

Timelines

Standard setup usually takes 5 working days for straightforward applications. Extra time needed includes:

- VIF processing: Add 2-3 business days

- Section 137 Bond: Add 7-10 days for arrangement and approval

- Name availability issues: Add 2-3 days if your preferred company name needs changes

Registration Process

The actual registration involves three key decisions that will affect how your e-commerce business operates and grows in the future.

Choose a Name

Your company name must be unique and not similar to existing Irish companies. For e-commerce businesses, think about how the name will look on product packaging, customer invoices, and online marketplaces like Amazon or eBay. The CRO has a searchable database where you can check if names are available before applying. They also have naming guidelines.

Avoid names that might limit future growth - "Dropshipping Ireland Ltd" might seem good at first but could restrict you if you expand into other products or markets beyond Ireland and the UK.

Choose Your Share Structure

E-commerce businesses benefit from flexible share structures. These help with future growth, giving shares to employees, and potential investment rounds. Consider setting up unlimited authorised share capital with low values (€0.01 per share). This gives you maximum flexibility to issue shares to key team members or investors without needing to change your company documents.

This structure costs nothing extra during setup but can save significant time and money later. This is useful when you want to offer equity to key employees or bring in partners for inventory financing or market expansion.

Registration

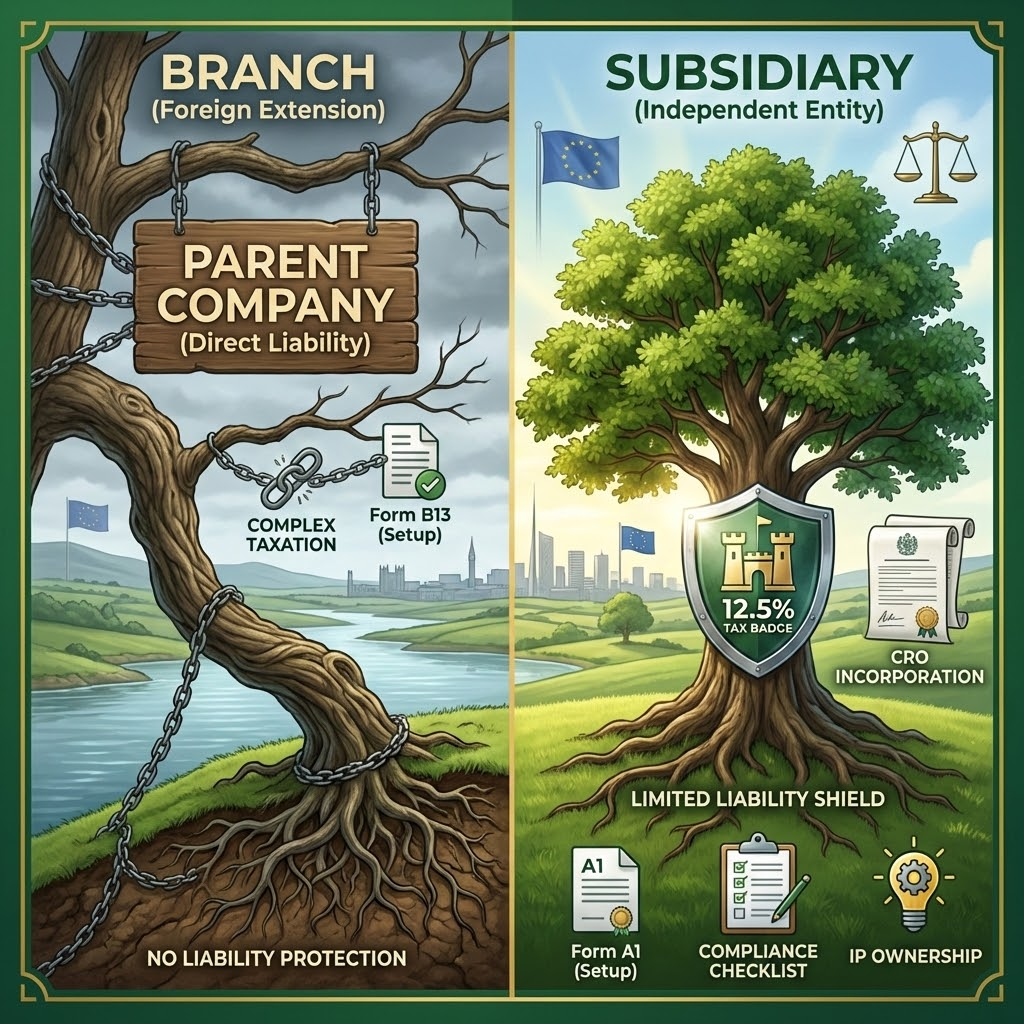

The registration process involves submitting Form A1 to the Companies Registration Office. This includes your company details, director information, and constitutional documents. Professional setup services like Open Forest handle this process efficiently. This ensures accuracy and compliance while you focus on preparing your e-commerce platform for launch.

After Registration Requirements

Once your e-commerce business is registered, you have several immediate obligations. These ensure ongoing compliance and proper corporate governance.

Legal Registers

Your company must keep statutory registers including the Register of Directors, Register of Members, and Register of Company Secretaries. These are living documents that need updates when changes happen. Authorities and certain stakeholders must be able to inspect them - although this rarely happens in practice.

For e-commerce businesses, keeping accurate registers becomes especially important when giving shares to employees or bringing in partners for inventory management or fulfillment These changes affect both legal compliance and tax obligations.

Share Certificates

Share certificates must be completed and ready within two months of issuing shares. Open Forest will prepare these, along with the Legal Registers, for you. These documents provide formal proof of ownership. They become important for employee share schemes or investment rounds that many successful e-commerce businesses eventually pursue for scaling operations.

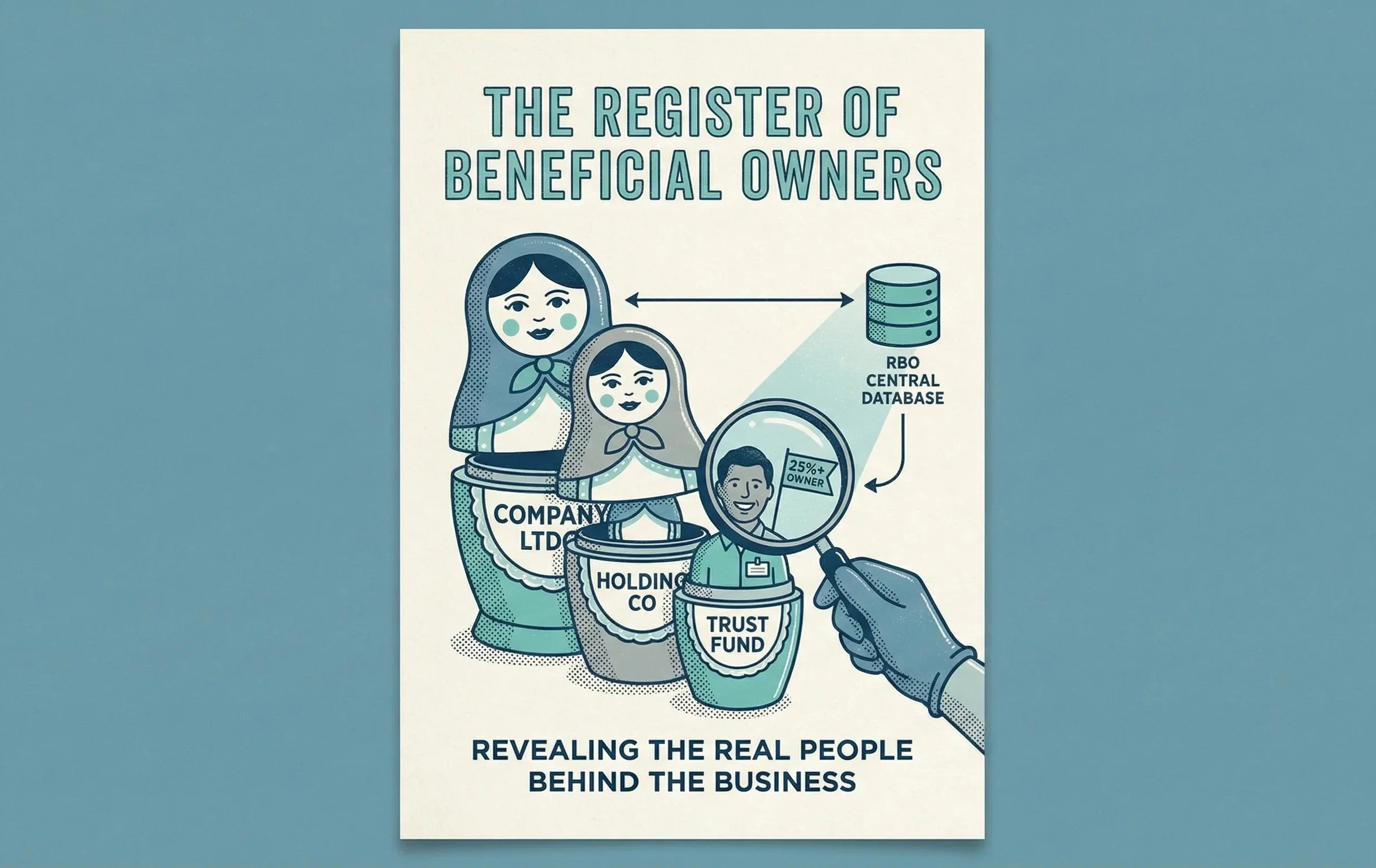

RBO Filing

You must submit details about beneficial ownership to the Register of Beneficial Ownership (RBO) within five months of setup. This includes information about anyone owning more than 25% of the company or having significant control over operations.

Annual Return

You must file the first annual return exactly six months after setup. After that, returns are due annually. Late filing costs €100 fines plus €3 daily penalties. More importantly, late filing can result in losing audit exemption for two years - potentially a €4,000 mistake for most e-commerce businesses.

Tax Registrations

E-commerce businesses must register for various taxes. This depends on what you do, your turnover levels, and cross-border sales patterns.

Corporation Tax

Every trading company must register for corporation tax within one month of starting to trade. For e-commerce businesses, "trading" usually begins when you start selling products to customers. This is true even if you haven't been paid by payment processors yet.

Ireland's 12.5% corporate tax rate applies to trading income. This makes setting up a company much more tax-efficient than operating as a sole trader for most e-commerce entrepreneurs.

VAT

VAT registration becomes mandatory when annual turnover exceeds €42,500 for goods sales. Many e-commerce businesses register voluntarily before reaching this threshold. This lets them reclaim VAT on substantial business expenses like stock purchases, shipping costs, software subscriptions, and equipment.

E-commerce businesses selling across EU borders must also consider VAT obligations in destination countries. The EU's One-Stop Shop (OSS) system simplifies cross-border VAT compliance. But proper registration and reporting procedures are essential to avoid penalties.

Legal Documentation

E-commerce businesses need specialised legal agreements. These address the unique challenges of online retail, supplier relationships, and consumer protection compliance.

- Terms and Conditions must clearly address product descriptions, pricing, delivery terms, and return policies. Include specific clauses about product availability, shipping timeframes, and customer service procedures. This prevents disputes that damage profitability and customer satisfaction.

- Privacy Policy and Cookie Policy are mandatory under GDPR for EU customers. Define what customer data you collect, how you use it, and customer rights regarding their personal information. E-commerce businesses often collect extensive customer data requiring robust privacy protection measures.

- Supplier Agreements establish product sourcing terms including minimum order quantities, quality standards, delivery schedules, and payment terms. Clear supplier agreements prevent misunderstandings about product specifications, delivery reliability, and exclusivity arrangements.

- Marketplace Agreements cover your relationship with platforms like Amazon, eBay, or Shopify. Include intellectual property protection, fee structures, and dispute resolution procedures. Many e-commerce businesses rely heavily on marketplace sales requiring careful contract management.

- Returns and Refunds Policy must comply with EU consumer protection laws. These give customers 14-day cooling-off periods for online purchases. Define return procedures, condition requirements, and refund timelines to ensure legal compliance while protecting business interests.

- Product Liability Insurance Agreements protect against claims related to defective products. E-commerce businesses face unique liability exposure from products sold to consumers across multiple jurisdictions.

Open Forest provides industry-specific legal agreement templates designed specifically for e-commerce businesses. These address common scenarios and potential disputes before they arise. They are all available to you after setup.

Business Banking

Setting up business banking for your e-commerce business requires specific documentation. You also need to consider your operational needs including payment processing and international transactions.

How Can Open Forest Help?

Open Forest offers specialised e-commerce incorporation packages starting from €99 including CRO fees. We provide industry-specific documentation including GDPR-compliant privacy policies, distance selling terms and conditions, and supplier agreement templates tailored for e-commerce operations.

Our platform helps you track compliance deadlines, annual filing requirements, and other compliance obligations specific to e-commerce businesses, so you can focus on growing your business rather than managing administrative requirements.

Choose from one of our incorporation packages here and we'll ensure your e-commerce business starts with the right legal foundation.

Stuart Connolly is a corporate barrister in Ireland and the UK since 2012.

He spent over a decade at Ireland's top law firms including Arthur Cox & William Fry.

.webp)

.webp)

.webp)